Critical Illness Insurance: Your Shield Against the Financial Impact of Major Health Crises

If you’re lucky, you’ve probably never had to use critical illness insurance. Perhaps you’ve never even heard of it. But in the event of a big health emergency, such as cancer, a heart attack, or a stroke, critical illness insurance could be the only thing standing between you and financial ruin.

What is Critical Illness Insurance?

Many people assume they’re fully protected with their standard health plan, but the exorbitant costs of treating life-threatening illnesses are usually more than any plan will cover. Critical illness insurance provides the insured a tax-free lump sum of money upon diagnoses with an illness covered under the policy. This money helps protect you from the financial burden of a serious illness by helping to pay for costs not covered by traditional insurance so that you can focus on your recovery.

A big draw of critical illness insurance is that the money can be spent on a variety of things, such as:

- To pay for critical medical services that might otherwise be unavailable.

- To pay for treatments not covered by a traditional policy.

- To pay for daily living expenses, enabling the critically ill to focus their time and energy on getting well instead of working to pay their bills.

- Transportation expenses, such as getting to and from treatment centers, retrofitting vehicles to carry scooters or wheelchairs, and installing lifts in homes for critically ill patients who can no longer navigate staircases.

- Terminally ill patients, or those simply in need of a restful place to recuperate, can use the funds to take a vacation with friends or family.

- Childcare

- Making up for lost wages or to funding time off work for the non-sick spouse/parent’s time off work.

Coverage limits vary—you could be eligible for a few thousand dollars all the way up to $100,000, depending on your policy. Policy pricing is impacted by a few factors, including the amount and extent of coverage, the sex, age, and health of the insured, and family medical history.

There are exceptions to critical illness insurance coverage. Some types of cancer may not be covered, while chronic illnesses are also frequently exempted. You may not be able to receive a payout if a disease comes back or if you suffer a second stroke or heart attack. Some coverage might end when the insured reaches a certain age. So, like any form of insurance, make sure to read the policy carefully. The last thing you want to worry about is your emergency plan.

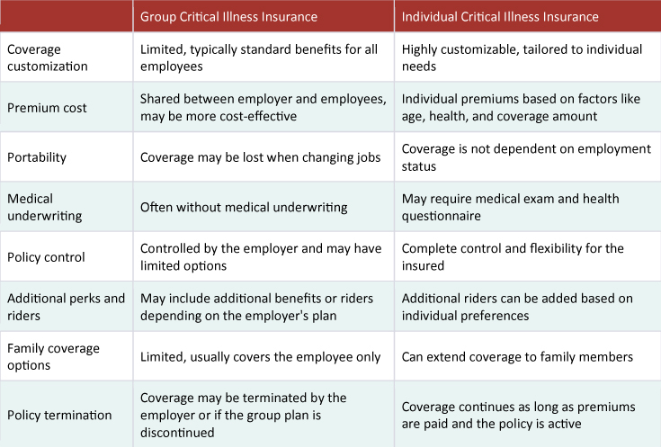

Group Critical Illness Insurance

Group Critical Illness Insurance is a critical illness policy sold to a group of people, typically at a workplace. Everyone in the group has the same options to pick from, often selected by their employer, and they can choose whether they want coverage. It’s often offered by employers as a benefit in the same way they may offer life or disability insurance, and it’s a great way for them to increase compensation to employees. It’s often more affordable than individual coverage and may not require a medical exam, but also offers limited benefits compared to an individual critical illness policy.

Limitations of Group Critical Illness Insurance

There are also some reasons why Group Critical Illness isn’t an ideal solution for everyone. First, it’s often limited to whatever your employer chooses – if you want to customize your coverage, you might not have many options to choose from. There’s also no guarantee you’ll be able to keep your coverage for as long as you want it – your employer might stop offering the plan, or you might change jobs and be unable to keep it.

Individual Critical Illness Insurance

Individual critical illness insurance is often purchased through an insurance agent or online and isn’t tied to your employment. The biggest advantage to individual critical illness insurance is that it can be tailored to your unique needs instead of a one-size-fits-all policy for your entire workplace. That means you can choose a plan that makes sense for you and your budget and get protection customized for your life. If you change jobs or retire, you can keep individual coverage with you no matter what since it isn’t tied to your employment. That makes it easier for you to maintain protection as you get older and are at a higher risk of severe illness.

Does Individual Critical Illness Insurance require a medical exam?

Whether or not you need a medical exam depends on the policy you choose. Many individual critical illness plans require a medical exam, but not all. Be sure to pay attention to the details of the plan to see if this is a requirement.

So what type of critical illness insurance is right for me?

Group and individual critical illness insurance are both great ways to protect your finances in case of a serious health event, but they come with their own advantages and disadvantages. Group critical illness insurance often comes with a lower price and ease of enrollment, but individual coverage gives you more options and may provide more robust protection. The most important thing, however, is making sure you get coverage.

You should consider your unique needs and where you are in life – if you’re young and healthy, an individual plan may offer more flexibility and long-term benefits. On the other hand, if you’re older or in poor health, you might find it easier to get coverage in a group plan. Or perhaps a combination of both!

Critical illness insurance is a smart way to safeguard your financial goals and maintain stability during sudden health emergencies. Whether you choose to get group coverage through your employer or seek out individual coverage, or do a combination of both, speak to your insurance professional to determine what the best coverage is for you.

Sources:

Group Critical Illness Insurance vs Individual: Which One… | Assurity

Critical Illness Insurance: What Is It? Who Needs It? (investopedia.com)